If one partner puts in $100,000 and the other only put in $25,000, they may opt for a 75/25 split instead. Most commonly, ownership will be divided based on the amounts each partner contributed to the business at the start.įor example, if two partners in a small business each contribute $100,000 to their business, they may agree to split profits (or possibly losses) 50/50.

It’s how profits and losses will be allocated that matters most come tax time, but there are many ways this can be sorted out. In addition to outlining the entity type of the business, partnership agreements include information on some important details, like how decisions will be made within the company and how profits will be allocated to partners. When starting a business, partners will often work with a lawyer to draft their partnership agreement. For instance, if you’re running a multi-member limited liability company (LLC) and you did not register to be taxed as a corporation, you will file taxes like a partnership using the Form 1065.ĭownload Guide Why Partnership Agreements Matter to 1065 Filings having a verbal agreement to conduct business as a partnership), you will file the Form 1065 even if you’re not registered as a partnership. Instead, all tax payments take place when partners file their personal income tax returns. In other words, while all partnerships need to file a Form 1065 each year, there is no required tax payment associated with it. This means profits and losses go directly through each partner, and each partner will enter their share of profits and losses on their personal tax returns. It’s important to note that all partnerships act as “pass-through” entities.

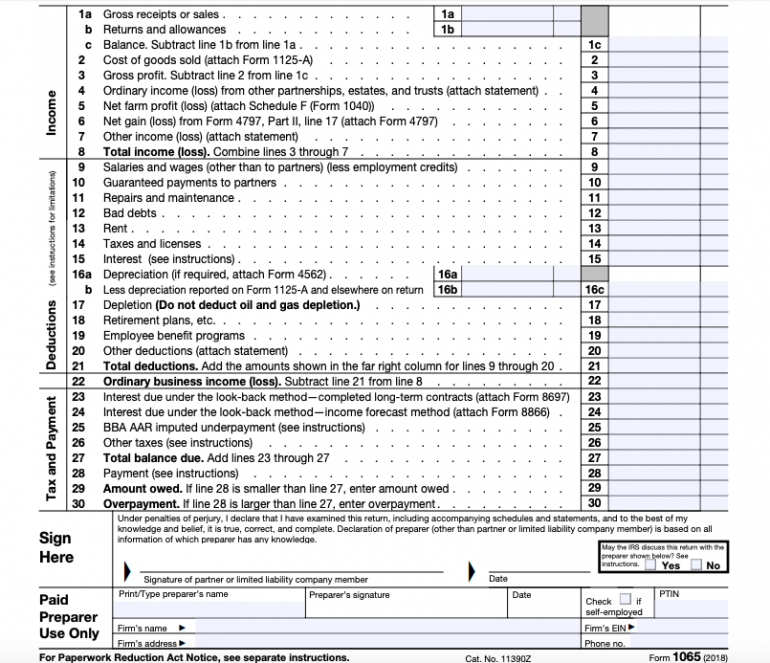

A partnership agreement could define your entity as a general partnership, limited partnership, limited liability partnership, LLC, etc. A partnership is a legal entity type formed by two or more individuals who sign a partnership agreement to run a business as co-owners. Who Needs to File Form 1065?Īll business partnerships must file Form 1065. On a Form 1065, partners will report their income, gains, losses, deductions, credits, and other information needed by the IRS. Return of Partnership Income, is the form used by business partnerships to file their yearly federal tax returns.

0 kommentar(er)

0 kommentar(er)